*/

By Louise Crush of Westgate Wealth Management sets out the key steps to your dream property

Mortgages can be difficult to navigate at the self-employed Bar, where you experience fluctuating income and aged debt. Alongside this, the mortgage market will be impacted by changes in government and fiscal policies, the regular Bank of England interest rate announcements and moveable inflation rates.

Buying your first home will be one of the biggest financial decisions you make in the early part of your life. Getting the right advice before you set off looking for the right property will help to make sure you don’t go over budget and have everything ready to proceed at the point you want to make an offer, giving you the best chance of having your offer accepted.

Your first mortgage will no doubt have an incentive deal which typically expires after 2 to 5 years. At that point – if you don’t take action – lenders will move you on to their standard variable rate, which can mean a significant increase in your monthly payments. Reviewing this six months before the end of your current deal allows time to get everything lined up for you to switch product or lender to make sure you avoid this jump in your payments by moving to a better deal in the market.

Looking to purchase a home can add a lot of additional administrative work to your schedule, when you are already time poor. It’s not quite as easy as 1, 2, 3; but if you follow our step-by-step guide, it can help you navigate what might otherwise feel an overwhelming task:

Being able to search quickly and efficiently from some of the best deals available in the market isn’t just a case of finding the best rate. Getting professional guidance allows you to benefit from advice around fixed or tracker rates, product terms and mortgage length.

Barristers may also benefit from bespoke underwriting, so lenders will understand how and when you are paid and what you can expect to earn in the coming years. Using an intermediary who knows the right lenders to speak to can help save you money and could make the difference between getting the property you want or not.

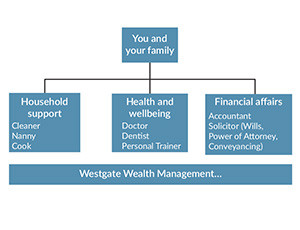

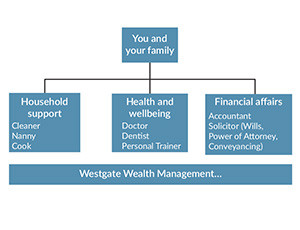

Your personal power team are there to help you make life easy. They are the ‘who’ for your ‘how’ tasks and have your best interests in mind, so you can make the most of an opportunity when it comes along.

Is Westgate on your personal power team? When you are ready to take your next step on the property ladder or review your existing mortgage and protection, book a no-obligation meeting with us, using the details below:

Mortgages can be difficult to navigate at the self-employed Bar, where you experience fluctuating income and aged debt. Alongside this, the mortgage market will be impacted by changes in government and fiscal policies, the regular Bank of England interest rate announcements and moveable inflation rates.

Buying your first home will be one of the biggest financial decisions you make in the early part of your life. Getting the right advice before you set off looking for the right property will help to make sure you don’t go over budget and have everything ready to proceed at the point you want to make an offer, giving you the best chance of having your offer accepted.

Your first mortgage will no doubt have an incentive deal which typically expires after 2 to 5 years. At that point – if you don’t take action – lenders will move you on to their standard variable rate, which can mean a significant increase in your monthly payments. Reviewing this six months before the end of your current deal allows time to get everything lined up for you to switch product or lender to make sure you avoid this jump in your payments by moving to a better deal in the market.

Looking to purchase a home can add a lot of additional administrative work to your schedule, when you are already time poor. It’s not quite as easy as 1, 2, 3; but if you follow our step-by-step guide, it can help you navigate what might otherwise feel an overwhelming task:

Being able to search quickly and efficiently from some of the best deals available in the market isn’t just a case of finding the best rate. Getting professional guidance allows you to benefit from advice around fixed or tracker rates, product terms and mortgage length.

Barristers may also benefit from bespoke underwriting, so lenders will understand how and when you are paid and what you can expect to earn in the coming years. Using an intermediary who knows the right lenders to speak to can help save you money and could make the difference between getting the property you want or not.

Your personal power team are there to help you make life easy. They are the ‘who’ for your ‘how’ tasks and have your best interests in mind, so you can make the most of an opportunity when it comes along.

Is Westgate on your personal power team? When you are ready to take your next step on the property ladder or review your existing mortgage and protection, book a no-obligation meeting with us, using the details below:

By Louise Crush of Westgate Wealth Management sets out the key steps to your dream property

The Bar Council is ready to support a turn to the efficiencies that will make a difference

By Louise Crush of Westgate Wealth Management

Marie Law, Director of Toxicology at AlphaBiolabs, examines the latest ONS data on drug misuse and its implications for toxicology testing in family law cases

An interview with Rob Wagg, CEO of New Park Court Chambers

What meaningful steps can you take in 2026 to advance your legal career? asks Thomas Cowan of St Pauls Chambers

Marie Law, Director of Toxicology at AlphaBiolabs, explains why drugs may appear in test results, despite the donor denying use of them

Ever wondered what a pupillage is like at the CPS? This Q and A provides an insight into the training, experience and next steps

The appointments of 96 new King’s Counsel (also known as silk) are announced today

Ready for the new way to do tax returns? David Southern KC continues his series explaining the impact on barristers. In part 2, a worked example shows the specific practicalities of adapting to the new system

Resolution of the criminal justice crisis does not lie in reheating old ideas that have been roundly rejected before, say Ed Vickers KC, Faras Baloch and Katie Bacon

With pupillage application season under way, Laura Wright reflects on her route to ‘tech barrister’ and offers advice for those aiming at a career at the Bar