*/

In Part 1 of this series, I reflected on how ‘it won’t happen to me’ is often relied upon to justify discounting financial protection. Pensions suffer a similar fate: ‘Retirement is ages away, I’ll worry about that in the future.’ The pensions landscape is continually evolving and we are becoming increasingly responsible for our retirement, which quickly comes around.

Planning a successful retirement is hard – the future is uncertain, quantifying the need isn’t an exact science and you have to balance saving with enjoying today. Do you need to change your savings plans to help you reach your goals? Here’s an example of what level of income pa is required for a single person (in today’s money), for different levels of retirement lifestyle:

State pension provision falls significantly short of what’s required. It might be available to those currently at state pension age, but there is nothing to say this will be the case in the future. You cannot rely on it to provide you with a retirement income.

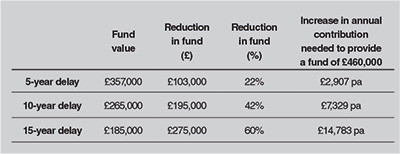

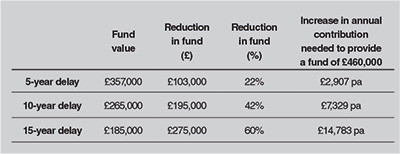

Albert Einstein observed: ‘The most powerful force in the universe is compound interest.’ Are you using it? The pension rules are clear: we have a choice of how much we can contribute and when. To put it another way: we have a choice of what we can do in retirement and when it can start. The key decision is when we start saving. The earlier you start, the easier it is to create the retirement lifestyle you want. If you were to invest £10,000 pa to a Registered Pension Scheme from age 30, subject to assumptions below, a projected fund of £460,000 would be available at age 60. A delay in your savings plan can have significant impact on this (see table).(2)

As self-employed sole traders, barristers can establish personal defined contribution pensions. These are different to other investment plans – contributions are boosted by tax relief. When you pay eligible contributions into a pension, the government tops it up – tax relief at basic rate is applied automatically and tax relief above this is claimable via your self-assessment. It is not often a policy favours higher earners. So, where affordable, it would be foolish not to benefit from it, while simultaneously planning for your future.

With frequent changes in legislation around pensions, comes complexity. There is an ‘annual allowance’ on the amount of contributions on which you can benefit from tax-relief now as much as £60,000 per annum, but… this is subject to your annual taxable income, the tapering rules applying.

Following the 2015 Pension Freedoms, you now have greater choice as to how to access your pension once you reach 55 (rising to 57 in 2028). Gone are the days when you had to purchase an annuity. While it might still be the right solution, all options should be considered to determine the one best suited. However, with this new-found freedom and control comes additional risks – most significantly, how you manage your retirement income so that it doesn’t run out. Working with an adviser and engaging with your retirement plans right from the start, provides you with peace of mind you’re protecting your future in your youth and enjoyment from a comfortable retirement lifestyle when you get there.

Book your no-obligation financial protection health check with Westgate today:

References: (1) The Pensions and Lifetime Savings Association/Loughborough University, Retirement Living Standards. (2) This example makes a number of assumptions: The average annual investment growth before charges is 4.61% each year. Investment charges of 1.96% each year. Contributions are invested on the same day in each year in a pension and are shown before charges are taken into account. The example is only an illustration and actual investment returns make be more or less than those assumed in the illustration. Please note that these benefits are not guaranteed. Benefits depend on how the investment grows and its tax treatment. Contributions are not limited by the Annual Allowance or by earnings.

SJP Approved 20/06/2024

Westgate Wealth Management Ltd is an Appointed Representative of and represents only St. James’s Place Wealth Management plc (which is authorised and regulated by the Financial Conduct Authority) for the purpose of advising solely on the group’s wealth management products and services, more details of which are set out on the group’s website www.sjp.co.uk/products. The St. James’s Place Partnership and the titles ‘Partner’ and ‘Partner Practice’ are marketing terms used to describe St. James’s Place representatives.

In Part 1 of this series, I reflected on how ‘it won’t happen to me’ is often relied upon to justify discounting financial protection. Pensions suffer a similar fate: ‘Retirement is ages away, I’ll worry about that in the future.’ The pensions landscape is continually evolving and we are becoming increasingly responsible for our retirement, which quickly comes around.

Planning a successful retirement is hard – the future is uncertain, quantifying the need isn’t an exact science and you have to balance saving with enjoying today. Do you need to change your savings plans to help you reach your goals? Here’s an example of what level of income pa is required for a single person (in today’s money), for different levels of retirement lifestyle:

State pension provision falls significantly short of what’s required. It might be available to those currently at state pension age, but there is nothing to say this will be the case in the future. You cannot rely on it to provide you with a retirement income.

Albert Einstein observed: ‘The most powerful force in the universe is compound interest.’ Are you using it? The pension rules are clear: we have a choice of how much we can contribute and when. To put it another way: we have a choice of what we can do in retirement and when it can start. The key decision is when we start saving. The earlier you start, the easier it is to create the retirement lifestyle you want. If you were to invest £10,000 pa to a Registered Pension Scheme from age 30, subject to assumptions below, a projected fund of £460,000 would be available at age 60. A delay in your savings plan can have significant impact on this (see table).(2)

As self-employed sole traders, barristers can establish personal defined contribution pensions. These are different to other investment plans – contributions are boosted by tax relief. When you pay eligible contributions into a pension, the government tops it up – tax relief at basic rate is applied automatically and tax relief above this is claimable via your self-assessment. It is not often a policy favours higher earners. So, where affordable, it would be foolish not to benefit from it, while simultaneously planning for your future.

With frequent changes in legislation around pensions, comes complexity. There is an ‘annual allowance’ on the amount of contributions on which you can benefit from tax-relief now as much as £60,000 per annum, but… this is subject to your annual taxable income, the tapering rules applying.

Following the 2015 Pension Freedoms, you now have greater choice as to how to access your pension once you reach 55 (rising to 57 in 2028). Gone are the days when you had to purchase an annuity. While it might still be the right solution, all options should be considered to determine the one best suited. However, with this new-found freedom and control comes additional risks – most significantly, how you manage your retirement income so that it doesn’t run out. Working with an adviser and engaging with your retirement plans right from the start, provides you with peace of mind you’re protecting your future in your youth and enjoyment from a comfortable retirement lifestyle when you get there.

Book your no-obligation financial protection health check with Westgate today:

References: (1) The Pensions and Lifetime Savings Association/Loughborough University, Retirement Living Standards. (2) This example makes a number of assumptions: The average annual investment growth before charges is 4.61% each year. Investment charges of 1.96% each year. Contributions are invested on the same day in each year in a pension and are shown before charges are taken into account. The example is only an illustration and actual investment returns make be more or less than those assumed in the illustration. Please note that these benefits are not guaranteed. Benefits depend on how the investment grows and its tax treatment. Contributions are not limited by the Annual Allowance or by earnings.

SJP Approved 20/06/2024

Westgate Wealth Management Ltd is an Appointed Representative of and represents only St. James’s Place Wealth Management plc (which is authorised and regulated by the Financial Conduct Authority) for the purpose of advising solely on the group’s wealth management products and services, more details of which are set out on the group’s website www.sjp.co.uk/products. The St. James’s Place Partnership and the titles ‘Partner’ and ‘Partner Practice’ are marketing terms used to describe St. James’s Place representatives.

The Bar Council is ready to support a turn to the efficiencies that will make a difference

By Louise Crush of Westgate Wealth Management

Marie Law, Director of Toxicology at AlphaBiolabs, examines the latest ONS data on drug misuse and its implications for toxicology testing in family law cases

An interview with Rob Wagg, CEO of New Park Court Chambers

What meaningful steps can you take in 2026 to advance your legal career? asks Thomas Cowan of St Pauls Chambers

Marie Law, Director of Toxicology at AlphaBiolabs, explains why drugs may appear in test results, despite the donor denying use of them

Ever wondered what a pupillage is like at the CPS? This Q and A provides an insight into the training, experience and next steps

The appointments of 96 new King’s Counsel (also known as silk) are announced today

Ready for the new way to do tax returns? David Southern KC continues his series explaining the impact on barristers. In part 2, a worked example shows the specific practicalities of adapting to the new system

Resolution of the criminal justice crisis does not lie in reheating old ideas that have been roundly rejected before, say Ed Vickers KC, Faras Baloch and Katie Bacon

With pupillage application season under way, Laura Wright reflects on her route to ‘tech barrister’ and offers advice for those aiming at a career at the Bar