*/

There is always going to be a place for cash in your short- and medium-term saving plans, but if you intend to save over the long term (typically 5+ years) then choosing to invest could be the best way to shield your money from inflation’s damaging effects and make your savings work as hard as possible.

Investment markets suffer almost cyclical disruptions which, understandably, can act as a deterrent. However, experiencing volatility is an inevitable part of an investment journey and by adopting certain investment principles you can manage risk, foster confidence and get the best chance of achieving your goals.

To create a balanced investment portfolio, it is important to use a blend of investment styles:

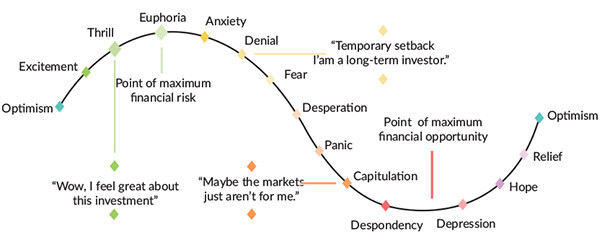

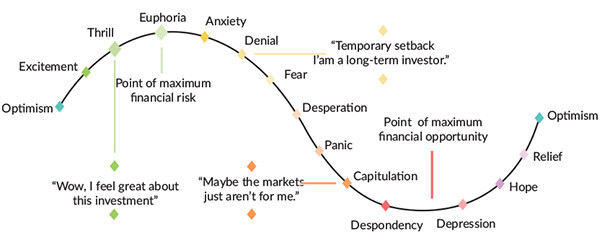

When markets are moving quickly, rash decisions driven by emotion rather than logic can threaten your financial health. It is essential during times of market volatility to retain a long-term perspective and not to make impulsive or irrational decisions.

The future is uncertain and diversification is our best protection against this. Having a number of different funds, each with a different focus, whether in terms of industry/sector or geographical/asset class allocation, can provide smoother and more consistent returns, avoid the risk of missing potential performance from assets you might otherwise not own and spread exposure across correlated and uncorrelated assets. Moreover, thinking we can make accurate predictions leads to less diversification, more risk and, almost inevitably, worse long-term outcomes. It is a relatively simple concept – not keeping all your eggs in one basket – yet can be difficult to do well.

There are thousands of stocks to pick from in the UK alone, so creating an investment portfolio with the best potential for growth, minimal volatility and at a risk level that suits you, is no easy task.

At Westgate, we take a team approach. Our advisers will help you craft a bespoke financial plan and we will work with you to keep this on track – amid all the investment noise. Our consulting fund managers make the stock-picking decisions and our expert investment management team is responsible for selecting, monitoring and changing (as necessary) the global fund managers.

So, ask yourself, do you:

If not, now is the time to review your plans. For a no obligation financial health check, contact Westgate today:

The value of an investment with St. James's Place will be directly linked to the performance of the funds you select and the value can therefore go down as well as up. You may get back less than you invested.

There is always going to be a place for cash in your short- and medium-term saving plans, but if you intend to save over the long term (typically 5+ years) then choosing to invest could be the best way to shield your money from inflation’s damaging effects and make your savings work as hard as possible.

Investment markets suffer almost cyclical disruptions which, understandably, can act as a deterrent. However, experiencing volatility is an inevitable part of an investment journey and by adopting certain investment principles you can manage risk, foster confidence and get the best chance of achieving your goals.

To create a balanced investment portfolio, it is important to use a blend of investment styles:

When markets are moving quickly, rash decisions driven by emotion rather than logic can threaten your financial health. It is essential during times of market volatility to retain a long-term perspective and not to make impulsive or irrational decisions.

The future is uncertain and diversification is our best protection against this. Having a number of different funds, each with a different focus, whether in terms of industry/sector or geographical/asset class allocation, can provide smoother and more consistent returns, avoid the risk of missing potential performance from assets you might otherwise not own and spread exposure across correlated and uncorrelated assets. Moreover, thinking we can make accurate predictions leads to less diversification, more risk and, almost inevitably, worse long-term outcomes. It is a relatively simple concept – not keeping all your eggs in one basket – yet can be difficult to do well.

There are thousands of stocks to pick from in the UK alone, so creating an investment portfolio with the best potential for growth, minimal volatility and at a risk level that suits you, is no easy task.

At Westgate, we take a team approach. Our advisers will help you craft a bespoke financial plan and we will work with you to keep this on track – amid all the investment noise. Our consulting fund managers make the stock-picking decisions and our expert investment management team is responsible for selecting, monitoring and changing (as necessary) the global fund managers.

So, ask yourself, do you:

If not, now is the time to review your plans. For a no obligation financial health check, contact Westgate today:

The value of an investment with St. James's Place will be directly linked to the performance of the funds you select and the value can therefore go down as well as up. You may get back less than you invested.

The Bar Council is ready to support a turn to the efficiencies that will make a difference

By Louise Crush of Westgate Wealth Management

Marie Law, Director of Toxicology at AlphaBiolabs, examines the latest ONS data on drug misuse and its implications for toxicology testing in family law cases

An interview with Rob Wagg, CEO of New Park Court Chambers

What meaningful steps can you take in 2026 to advance your legal career? asks Thomas Cowan of St Pauls Chambers

Marie Law, Director of Toxicology at AlphaBiolabs, explains why drugs may appear in test results, despite the donor denying use of them

Ever wondered what a pupillage is like at the CPS? This Q and A provides an insight into the training, experience and next steps

The appointments of 96 new King’s Counsel (also known as silk) are announced today

Ready for the new way to do tax returns? David Southern KC continues his series explaining the impact on barristers. In part 2, a worked example shows the specific practicalities of adapting to the new system

Resolution of the criminal justice crisis does not lie in reheating old ideas that have been roundly rejected before, say Ed Vickers KC, Faras Baloch and Katie Bacon

With pupillage application season under way, Laura Wright reflects on her route to ‘tech barrister’ and offers advice for those aiming at a career at the Bar