*/

Lana Murphy and Francesca Perera started their careers at the Crown Prosecution Service before joining chambers. They discuss why they made the move and the practicalities of setting up self-employed practice as qualified juniors

There are pros and cons to both employed and self-employed practice. The advantages of being employed include a regular and predictable income, a pension contributed to by your employer, paid annual leave and sick pay etc. The benefits of being self-employed may include greater control over your practice, and faster career progression and development – the corollary of which may be the capacity to earn more.

Making the move from employed to self-employed can be a tough decision and a daunting prospect, especially when all you have ever known is the former. I undertook my pupillage at the Crown Prosecution Service (CPS) and, shortly after qualifying, was promoted to the role of Senior Crown Prosecutor.

With a year of practice under my belt, I took the leap and joined Chambers which was the right decision for both my practice and me. That is not to say this will be the perfect fit for everyone, and I am indebted to the CPS for the support and guidance I received.

Regrettably (and rather foolishly), as a pupil I had tuned out during the session run by Circuit which detailed the ins and outs of setting up a self-employed practice. This meant that when I made the decision to join Chambers, I was very much in the dark about what I needed to do.

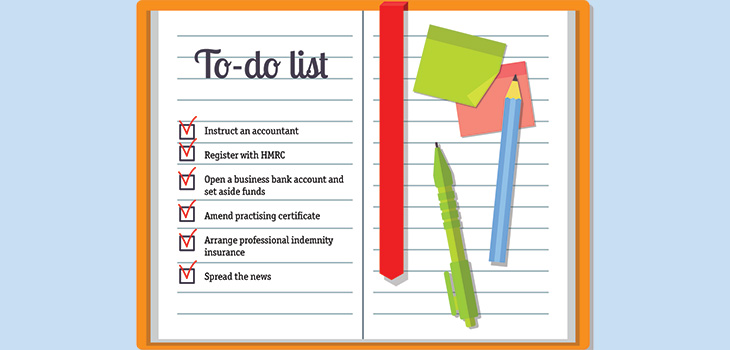

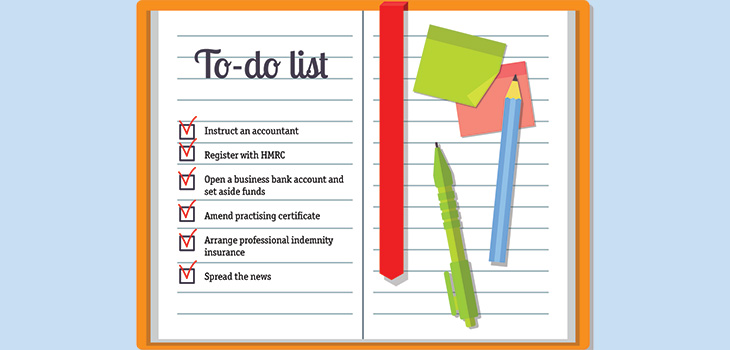

Fortunately, Joseph Broadway (my co-pupil and a colleague at Albion Chambers) had already made the move and provided me with a ‘to-do’ list.

Finally, I would urge you to have conversations with other self-employed barristers – they are well-placed to answer any of your queries.

I started my career at the Crown Prosecution Service (CPS) where I completed pupillage, qualified and then remained there as an employed barrister in the role of Crown Prosecutor for around a year. As part of that role, I prepared and reviewed cases as well as prosecuting all types of hearings and cases in the Magistrates’ Court. The benefits and appeal of being an employed barrister are obvious: a regular and stable income, a good pension, annual leave and the ability to work flexibly. However, I was keen to have a Crown Court practice, and I also wanted to defend. To conduct Crown Court advocacy at the Crown Prosecution Service you have to be a Crown Advocate. The competition to become a Crown Advocate is high and there are relatively few roles. Therefore, towards the end of 2021 I started to consider a move to the self-employed Bar.

Before deciding whether or not to move I spoke to other self-employed barristers to obtain their advice on moving and how I could best prepare for the change. The advice that I received was broadly the same – there is a delay in receiving payment, there is no pension or annual leave but my career could develop faster and I would be exposed to more complex and challenging cases at the self-employed Bar.

In early 2022 I took the plunge and successfully applied for tenancy at No5 Chambers. Before leaving the CPS, I made sure that I had saved enough money to allow for the delay in payment and sought advice from an accountant. The change in the work I do has been significant. I now prosecute and defend in the Crown Court on a daily basis. I conduct trials for offences such as drugs, sexual offences and assault. I have been briefed as junior counsel for offences such as GBH with intent, firearms, drugs and murder. Alongside my crime practice I am also developing a regulatory practice. I know that the skills I developed while working at CPS have helped me in advancing my current practice.

Life at the self-employed Bar isn’t for everyone. You have to be prepared to adjust your work-life balance and to manage the variations in cashflow more carefully. There are also added complications that you don’t have when you’re employed, such as putting money aside for tax, VAT and a pension. You are essentially operating your own small business. But, after overcoming the initial worries about the uncertain world of self-employed practice, the positives far outweigh any negatives. I am so pleased that I moved to the self-employed Bar and while it is a personal decision for every barrister, I know that it was the right one for me.

There are pros and cons to both employed and self-employed practice. The advantages of being employed include a regular and predictable income, a pension contributed to by your employer, paid annual leave and sick pay etc. The benefits of being self-employed may include greater control over your practice, and faster career progression and development – the corollary of which may be the capacity to earn more.

Making the move from employed to self-employed can be a tough decision and a daunting prospect, especially when all you have ever known is the former. I undertook my pupillage at the Crown Prosecution Service (CPS) and, shortly after qualifying, was promoted to the role of Senior Crown Prosecutor.

With a year of practice under my belt, I took the leap and joined Chambers which was the right decision for both my practice and me. That is not to say this will be the perfect fit for everyone, and I am indebted to the CPS for the support and guidance I received.

Regrettably (and rather foolishly), as a pupil I had tuned out during the session run by Circuit which detailed the ins and outs of setting up a self-employed practice. This meant that when I made the decision to join Chambers, I was very much in the dark about what I needed to do.

Fortunately, Joseph Broadway (my co-pupil and a colleague at Albion Chambers) had already made the move and provided me with a ‘to-do’ list.

Finally, I would urge you to have conversations with other self-employed barristers – they are well-placed to answer any of your queries.

I started my career at the Crown Prosecution Service (CPS) where I completed pupillage, qualified and then remained there as an employed barrister in the role of Crown Prosecutor for around a year. As part of that role, I prepared and reviewed cases as well as prosecuting all types of hearings and cases in the Magistrates’ Court. The benefits and appeal of being an employed barrister are obvious: a regular and stable income, a good pension, annual leave and the ability to work flexibly. However, I was keen to have a Crown Court practice, and I also wanted to defend. To conduct Crown Court advocacy at the Crown Prosecution Service you have to be a Crown Advocate. The competition to become a Crown Advocate is high and there are relatively few roles. Therefore, towards the end of 2021 I started to consider a move to the self-employed Bar.

Before deciding whether or not to move I spoke to other self-employed barristers to obtain their advice on moving and how I could best prepare for the change. The advice that I received was broadly the same – there is a delay in receiving payment, there is no pension or annual leave but my career could develop faster and I would be exposed to more complex and challenging cases at the self-employed Bar.

In early 2022 I took the plunge and successfully applied for tenancy at No5 Chambers. Before leaving the CPS, I made sure that I had saved enough money to allow for the delay in payment and sought advice from an accountant. The change in the work I do has been significant. I now prosecute and defend in the Crown Court on a daily basis. I conduct trials for offences such as drugs, sexual offences and assault. I have been briefed as junior counsel for offences such as GBH with intent, firearms, drugs and murder. Alongside my crime practice I am also developing a regulatory practice. I know that the skills I developed while working at CPS have helped me in advancing my current practice.

Life at the self-employed Bar isn’t for everyone. You have to be prepared to adjust your work-life balance and to manage the variations in cashflow more carefully. There are also added complications that you don’t have when you’re employed, such as putting money aside for tax, VAT and a pension. You are essentially operating your own small business. But, after overcoming the initial worries about the uncertain world of self-employed practice, the positives far outweigh any negatives. I am so pleased that I moved to the self-employed Bar and while it is a personal decision for every barrister, I know that it was the right one for me.

Lana Murphy and Francesca Perera started their careers at the Crown Prosecution Service before joining chambers. They discuss why they made the move and the practicalities of setting up self-employed practice as qualified juniors

The Bar Council is ready to support a turn to the efficiencies that will make a difference

By Louise Crush of Westgate Wealth Management

Marie Law, Director of Toxicology at AlphaBiolabs, examines the latest ONS data on drug misuse and its implications for toxicology testing in family law cases

An interview with Rob Wagg, CEO of New Park Court Chambers

What meaningful steps can you take in 2026 to advance your legal career? asks Thomas Cowan of St Pauls Chambers

Marie Law, Director of Toxicology at AlphaBiolabs, explains why drugs may appear in test results, despite the donor denying use of them

Ever wondered what a pupillage is like at the CPS? This Q and A provides an insight into the training, experience and next steps

The appointments of 96 new King’s Counsel (also known as silk) are announced today

Ready for the new way to do tax returns? David Southern KC continues his series explaining the impact on barristers. In part 2, a worked example shows the specific practicalities of adapting to the new system

Resolution of the criminal justice crisis does not lie in reheating old ideas that have been roundly rejected before, say Ed Vickers KC, Faras Baloch and Katie Bacon

With pupillage application season under way, Laura Wright reflects on her route to ‘tech barrister’ and offers advice for those aiming at a career at the Bar